Construction Payroll Services Do Exist for Contractors

Content

Pay-As-You-Go Workers’ Compensation options so that your premium is calculated and paid each week based on your actual wages. But Roll by ADP lets you easily run payroll yourself in under a minute and handles tax filing too. For those who are just getting started, you can build a construction company in a few easy steps.

From staying on top of changing payroll taxes to accurately withholding, processing payroll correctly and on time may keep an HR department busy. Incorporating this type of service into payroll operations can help businesses save time and money while also boosting efficiency. ADP Payroll is the perfect tool for construction companies looking to track their employee time and pay without the hassle and confusion.

ACA & W-2 Services

This is another reason why investing in essential Construction Payroll Services payroll software is essential. Not only will it help to cut costs by providing accurate project reports and tax filings, but it will also help to provide vital documentation and facilitate discussions with union leaders. If you use QuickBooks for accounting and want a simple payroll processor with basic HR functions, QuickBooks Payroll offers a surprising amount of functionality for construction companies. The Premium and Elite plans include same-day direct deposit, something not offered by others on our list.

You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Easily calculate fringes and deductions based on regular, overtime or special rates. Check out our guide on finding the right payroll solution for tips on how to best evaluate the right payroll for you.

What is the best payroll service for a small construction company?

When you’re the owner of a smaller operation, though, you often end up wearing multiple hats at the same time. And since you’re usually the one handling the money, you’re the one responsible for making sure the people on your payroll get paid accurately and on time. Payroll is utilized by organizations that employ hourly workers, such as restaurants and retail establishments, in addition to construction companies. When making this decision, crucial factors to evaluate should include the amount of customer assistance, the diversity of employee records they can manage, and their industry experience. My Construction Payroll is a cutting-edge service that ensures that construction workers are paid appropriately and on schedule. With ConstructionPayroll, businesses can improve their efficiency, lower their risks and have peace of mind when it comes to paying their construction staff.

- We offer solutions for payroll processing, workers’ compensation, compliance, time and attendance, and more.

- My Construction Payroll is a cutting-edge service that ensures that construction workers are paid appropriately and on schedule.

- It’s also the only service on our list that offers a fringe benefits trust fund from which employees can take cash advances.

- Wagepoint can automate the process of approving payrolls for recurring payouts such as monthly salaries and deductions.

- Roll by ADP allows you to make immediate changes to payroll, hours and even who is on your payroll –all from your phone.

- Best overall construction payroll software.Best overall construction payroll software.

As a Professional Employer Organization , Rippling provides several business management services and solutions, including payroll, HR, benefits administration, and IT management. Keep reading for an in-depth look at our best construction payroll software picks, including pricing, features, and much more. We relieve worries over complex tax compliance by deducting taxes and filing on-time tax payments and forms to federal, state, and local authorities. Forms include 940, 941, W-2, and 1099 forms for contractors. Payroll4Construction has all the features needed by contractors, making it easy to use for both experienced and novice professionals alike.

New York Contracting & Construction Payroll Services

Our technology scales with the needs of your Construction or Manufacturing Business. Whether you have 1 employee or 1,000 employees, we have the right combination of solutions for your business. CheckWise Payroll provides Payroll, Human Resource, and Timekeeping services to businesses of all sizes and industries. Plus, our full staff of construction payroll specialists are available to help you with all your payroll questions and needs.

If you’re working with a small operation, you might want the best payroll options tailored for your business demographic. You can check out our guide to the best payroll software for small business. Namely lets you know how long your staff has taken time off work.

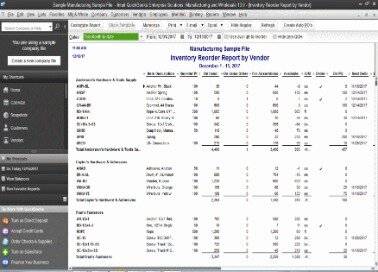

Payroll4Construction Reports

In addition, modifiers like bonuses, leaves, and reimbursements are accounted for and applied to payment balances. A list of activities is presented so you would know who updated payroll at any given time. Justworks displays many options for health insurance, fitness plans, and health and wellness services. Big providers like Aetna, Metlife, and One Medical offer attractive plans.

Your payroll service is going to need in-depth knowledge of the labor and tax laws of your local state and industry. Every state is different, and labor laws can change dramatically from area to area. Additionally, contractors come to us all the time because their current payroll service is too difficult to reach during business hours. Voicemail messages are ignored, and their calls aren’t returned.

Features

However, these clocks often reside at a permanent installation. Its always on Ethernet connection to the web means punches are instantly recorded into software and made available for review, though. Even with its benefits, businesses should consider their needs carefully with biometric machines; there is a potential for a higher setup cost, plus the need to safeguard fingerprint data. If more than half of the carpenters in a county’s largest city receive a similar rate of pay, then that is the wage that prevails. However, it’s a little more complex than it seems on the surface. To determine the fair wage for builders working under federal contract, a regulatory body examines a number of important factors.

What is the most popular payroll system?

- #1 Gusto – Best Payroll Software of 2023.

- #2 OnPay – Best Small Business Payroll Software of 2023.

- #3 Patriot – Best Payroll Software for Startups.

- #4 Block (formerly Square) – Best Payroll Software for Contractors.

- #5 ADP – Best Variety of Payroll Options.

- #5 SurePayroll.

Users can input basic information such as dates and times worked, job and pay codes, total wages, prevailing wage rates, and more. Create projects in the software, and designate employees individually to each group for accurate tracking of their hours across multiple job sites. Although Gusto isn’t billed as construction payroll software, its services can be used by construction businesses needing basic payroll, HR, and tax support. Better yet, Gusto is notably easy to use, and its customer support options make it easy to get help or guidance when you need it. Construction payroll is a unique and challenging process. Many contractors become overwhelmed from managing multiple projects on separate sites, dealing with payroll compliance, and handling constant changes in workers.