Enrolled Agent EA Certification

Contents:

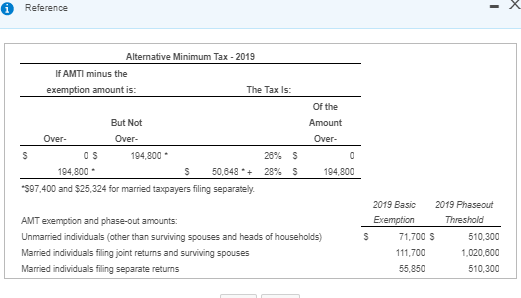

Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. Pathward does not charge a fee for this service; please see your bank for details on its fees. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. There are currently no educational requirements to become an enrolled agent. Many consider this option as an alternative to traditional college or university backgrounds.

- Each exam lasts 3.5 hours and contains 100 multiple choice questions.

- Once you are listed as an enrolled agent and have joined tax organizations, it’s now time to focus on building your client base.

- You may have unlimited flexibility, but you’ll have to earn clients to make money.

- EAs can take on a variety of responsibilities and grow into the role of a tax professional.

Please help us protect Glassdoor by verifying that you’re a real person. If you continue to see this message, please emailto let us know you’re having trouble. You may not be paid quite as well as if you worked in the private sector, but you may enjoy working for a public-serving entity.

Enrolled Services Coordinator

Becoming an enrolled agent can take your tax-preparing skills to another level. Read on to learn how to earn a license and access additional resources. Get a competitive hourly wage with overtime during peak hours helping TurboTax customers. Correspondence or individual study programs that require registration, measure completion of the program , and provide or require a written outline, textbook, or suitable electronic educational materials. Now that enrolled agents are required to have a Preparer Tax Identification Number , some of the administrative tasks involved in managing EAs have been rolled into the PTIN process.

Spotlight on Connecticut Enrolled Agent Morris Armstrong – Bloomberg Tax

Spotlight on Connecticut Enrolled Agent Morris Armstrong.

Posted: Fri, 27 Jan 2023 08:00:00 GMT [source]

As small businesses, many law firms will benefit from having tax personnel on staff to handle their own taxes. Mailchimp provides the momentum small businesses need to help them grow the way they want. All three parts of the SEE must be passed within a two-year window. Each exam lasts 3.5 hours and contains 100 multiple choice questions.

Search top-tier programs curated by your interests.

If you’re an enrolled agent looking to gain experience in the field, it can be challenging to find new opportunities and a daunting task to figure out your ideal career path. Description of benefits and details at hrblock.com/guarantees. Based on their renewal cycle, each agent must complete 72 hours of continuing education, with a minimum of 16 hours each year.

National databases of CPAs, there are approximately 650,000 CPAs who are currently practicing in the United States. Bachelors degree in Accounting or related field. Looking for talented professionals to make our nation stronger. Please stand by, while we are checking your browser…

Becoming an Enrolled Agent: Experience

You will use the latest in computers, telecommunications and https://1investing.in/ management systems, and apply your knowledge of Internal Revenue Code, rulings, court decisions, agency policies, regulations and more. Each of these areas offer upsides and downsides, and different firms within each area may offer different opportunities. You may find a bank that offers a great salary and flexible schedule, it’s just a matter of looking at your options. You can make a lot of money, but you may have more clients than you want to deal with. It’s all about balance when owning your own business. Each of these areas has ups and downs, and different firms within each area may offer different opportunities.

- Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

- We know that innovation thrives in an inclusive environment.

- Enrolled agents who prepare tax returns, along with all other tax preparers, are required to have a Preparer Tax Identification Number .

- Discounted private health insurance, novated lease arrangements & more.ABOUT THE ROLE We are seeking a passionate and friendly endorsed enrolled nurse to join our team at Mercy Care Centre Young..

We serve our customers, 7 days a week from 5am to 9pm PT. You must be able to commit to a minimum schedule of at least 20 hours/week throughout the tax season. You’ll be helping our customers do their own taxes by providing expert guidance, tax explanations, and advice so they can file confidently with TurboTax. For example, many of our customers need help with reporting deductions, rental properties, etc., and you’ll be the tax expert they turn to for advice and reassurance. In some cases you may prepare their return, sign, and file their taxes.

They can work with corporations, individuals, trusts, non-profits, or a variety of other entities. They can also work in tax areas ranging from calling the IRS on notices to helping clients strategize to legally maximize tax benefits. WebGregory Crofton, CFP, EA, MBA offers professional tax services in Pleasanton, CA. Learn how an Enrolled Agent tax expert can help you today. The flexibility with the work hours and the support you’re provided with is unparalleled. To be successful in any of the positions for an enrolled agent, it’s essential to possess excellent attention to detail and the capacity to do your job quickly and effectively. Discover more about the roles and salary ranges for enrolled agents in ourEA salary guide.

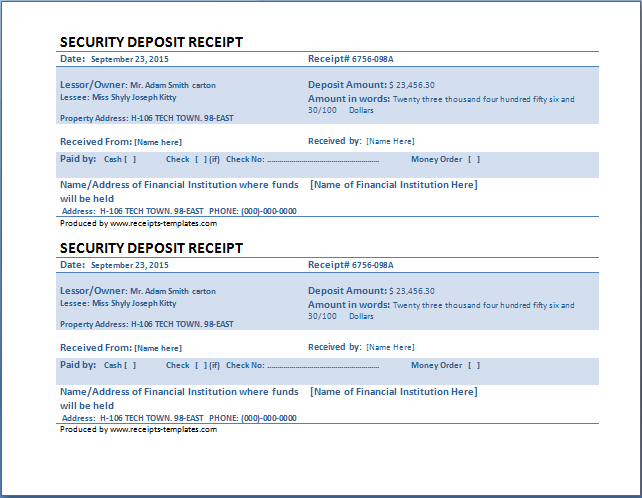

After submitting the application, known as Form 23, accepted applicants can expect to receive their bookkeeping cards within 120 days. If a taxpayer is not satisfied with an IRS decision, the taxpayer has the right to take the issue to tax court where a judge will decide the matter. Typically, only attorneys can represent a person in court; however, other Circular 230 professionals, including enrolled agents, can take the tax court exam and qualify to represent taxpayers. As for occupational duties, enrolled agents are empowered to represent American taxpayers before the IRS on matters such as collections, tax appeals, audits, and any other tax issues. With the support of your supervisors, you’ll work to interview and resolve issues, and elevate more complex problems to other departments. Keep in mind that you don’t have to pick one of these to be your lifelong career.

Displayed here are Job Ads that match your query. SimplyHired may be compensated by these employers, helping keep SimplyHired free for job seekers. SimplyHired ranks Job Ads based on a combination of employer bids and relevance, such as your search terms and other activity on SimplyHired.

Job Seeker Tools

Small business owners don’t have the time to deal with tax-related matters or IRS notices. It’s an advantage for them to have someone on staff to handle accounting throughout the year and taxes during tax season. Enrolled agents can take on a variety of responsibilities and grow into the role of a tax professional. Small accounting firms can also offer a lot of benefits in terms of scheduling, time-off, work from home opportunities and growth. Individuals who are considering a new career path may find that becoming an enrolled agent is the right choice.

Agents can file their renewal applications online or on paper. An international test administration agency, Prometric administers the SEE on behalf of the IRS. Test-takers can access a variety of resources through Prometric. Resources include extensive information about the test, scoring, and retesting. Prometric also offers a 30-minute test simulation. EA candidates who do not pass part of the exam may retake that section up to four times within the testing window.

By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. H&R Block Free Online is for simple returns only. No one offers more ways to get tax help than H&R Block. Payroll Payroll services and support to keep you compliant.

We make them quietly powerful, with AI-driven content and insights. So as our customers’ businesses grow, the services we offer grow alongside them. This means we’ve put the power of growth in every customer’s hands, whether they’re just starting out or looking to seriously level up. Beyond legal matters, an enrolled agent can also serve as your neighborhood Tax Pro providing tax return filing services in-season. Or, addressing IRS letters that are sent as a result of needing to provide more documentation, filing amendments, etc.

You are also eligible for a bonus paid out at the end of the season based upon performance. Performance depends on customer feedback, issue resolution, and completion of the assigned season. Work with corporations to prepare corporate tax returns. Work with small businesses in a specific industry or industries, for example, choosing to work only with home-based businesses or medical practices. If an individual wants to become an enrolled agent, there are several requirements that must be met in order to gain that title. Discussed below are the steps needed to be taken in order to achieve the EA title.